If you’re a real estate investor in the vibrant market of Florida, the term ‘1031 exchange’ might ring a few bells. This powerful tool can significantly impact your investment strategies, tax liabilities, and overall financial portfolio. Whether you’re eyeing beachfront property in Miami, a rental home in Orlando, or a sprawling estate in Naples, understanding the ins and outs of the 1031 exchange is essential.

In this comprehensive guide, we’ll walk you through the specific requirements and process timeframes relevant to Florida real estate investors. You’ll find detailed insights on the benefits and potential drawbacks of a 1031 exchange, alongside a roadmap of which properties qualify. Get ready to unlock the potential of your Florida real estate investments with the mighty 1031 exchange.

The Nuts and Bolts of a 1031 Exchange in Florida

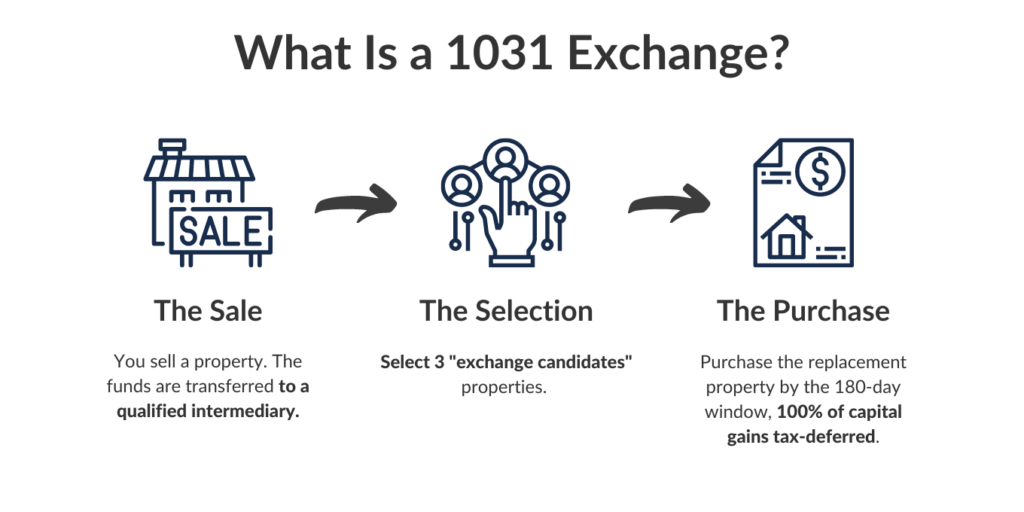

A 1031 exchange, named after section 1031 of the IRS tax code, allows you to defer capital gains taxes on investment properties when you sell one property and reinvest in another. The principle is simple but the process involves a few critical steps and considerations unique to Florida.

Requirements and Process Timeframes

To participate in a 1031 exchange, you must adhere to strict regulations. In Florida, there is no state capital gains tax, but investors still have to factor in federal tax and the peculiarities of the Florida market.

Identifying Replacement Property

Within 45 days of selling your property, you must identify potential replacement properties. Florida’s diverse real estate landscape offers numerous choices, from commercial properties in Downtown Tampa to development lots in Palm Beach County.

Acquiring Replacement Property

Once identified, you have 180 days from the sale of your property to close on the replacement property. The common advice here is to act quickly, as Florida’s real estate market can be fast-paced.

Like-Kind Property

Both the relinquished and replacement properties must be of a ‘like-kind’ nature, but these parameters are broad in Florida. It could mean exchanging a shopping plaza in Jacksonville for an office building in Jacksonville or a townhouse in St. Petersburg Beach for an apartment complex in Sarasota.

Qualified Intermediary

You cannot touch the proceeds from the sale of your property, so hiring a Qualified Intermediary (QI) is mandatory. The QI holds the money in escrow until it’s time for the exchange.

Pros and Cons of a 1031 Exchange in Florida

The allure of a 1031 exchange for Florida real estate investors is undeniable, but like any financial strategy, it has its share of advantages and disadvantages.

The Advantages

The primary benefit for Floridian investors is clear: a 1031 exchange allows you to reinvest more capital back into another property by deferring taxes. This can lead to more significant and accelerated investment growth. Given the robust and growing economy, as well as the sheer variety of Florida real estate, this can be a game-changer for investors.

Building on Property Appreciation

Florida real estate has enjoyed substantial growth in property appreciation. A 1031 exchange enables investors to leverage this gain tax-free, ultimately leading to larger, more profitable investments.

Diverse Investment Opportunities

By deferring taxes through a 1031 exchange, Florida investors can tap into the state’s diverse real estate offerings without the financial encumbrance of immediate tax payment.

The Drawbacks

It’s not all sunshine and palm trees when it comes to 1031 exchanges. There are potential pitfalls, most notably the complexity of the process and the stringent deadlines.

High Stakes with Timelines

The deadlines associated with identifying and acquiring replacement properties are not flexible. Any delay or misstep in the process can have costly tax implications.

Transaction Costs

Engaging in a 1031 exchange involves transactional costs, such as fees paid to the QI, that can eat into your overall profit.

What Properties Qualify for a 1031 Exchange in Florida?

The IRS does not specify which types of properties qualify, but it is clear that both the relinquished and replacement properties must be held for investment, income, or business purposes. In Florida, with its array of real estate opportunities, the variety of properties that could fall under this umbrella is extensive.

Residential Properties

Apartment complexes, condominiums, single-family homes for rent, and even vacation rentals all potentially qualify, given they meet the investment criteria.

Location Benefits

Florida real estate offers unique location benefits in terms of quality of life and market demand. Residential properties near scenic coastal areas or thriving city centers can be hot investments, and a 1031 exchange can help you capitalize on these prime locations.

Commercial and Business Properties

With its growing business landscape, Florida’s commercial properties are a fertile ground for a 1031 exchange. Office spaces, retail outlets, warehouses, and more can apply, keeping within the stipulated investment parameters.

High-Return Sectors

Certain sectors, like medical office buildings and new industrial development, are experiencing rapid growth and could offer substantial potential for exchange.

Land and Development Properties

Investors looking to capitalize on Florida’s development potential can also benefit from a 1031 exchange with land and unimproved properties earmarked for future growth.

Navigating Zoning Restrictions

Florida has specific zoning regulations, and it’s crucial to ensure that any potential replacement properties align with these and your investment strategy.

In Conclusion

A 1031 exchange can be a powerful tool for real estate investors in Florida, but it’s not without its complexities. By understanding the requirements, process timeframes, and the particular advantages and drawbacks, you can make informed decisions to enhance your portfolio.

For investors in the Sunshine State, the potential to leverage Florida’s dynamic real estate market through a 1031 exchange is only a transaction away. With the wealth of opportunities available, careful planning and the right guidance can lead to exciting new horizons in your investment pursuits.

Navigating Florida’s real estate market and tax laws can be daunting, but with the right knowledge and professional support, a 1031 exchange can significantly bolster your investment endeavors. Whether it’s verdant landscapes for future development or bustling commercial hubs, the keys to prosperous property exchanges lie in thorough preparation and strategic foresight.